The 23rd World Insights

Exploring the untold stories and events from around the globe.

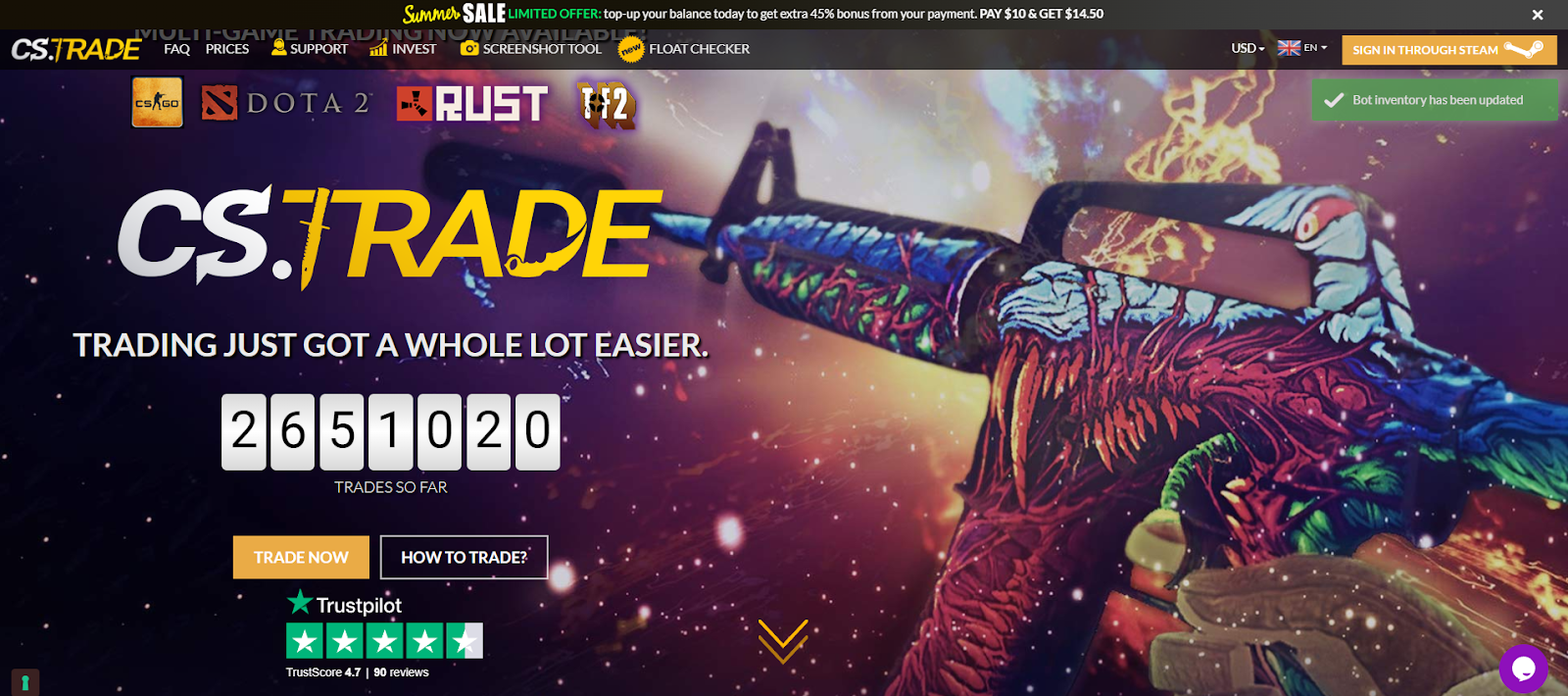

Bots Gone Wild: Navigating the CS2 Trade Jungle

Unleash the chaos of CS2 trading! Discover insider tips to master the trade jungle and outsmart the bots—your ultimate guide awaits!

Understanding the CS2 Trade Landscape: A Beginner's Guide

Welcome to our beginner's guide on understanding the CS2 trade landscape. In this digital age, trading virtual items in games like Counter-Strike 2 (CS2) has become a booming market. Players trade skins, stickers, and other in-game items for real-world currency or other valuable items. Before diving into trading, it's crucial to familiarize yourself with the different markets and platforms where these transactions take place.

To get started, you should focus on a few key concepts and strategies:

- Market Research: Stay updated on current trends and the value of items.

- Trading Platforms: Utilize reputable sites and exchanges for safe transactions.

- Understanding Scarcity: Learn about rarity and demand, as these factors significantly influence item prices.

By grasping these fundamentals, you'll be well on your way to navigating the CS2 trade landscape with confidence!

Counter-Strike is a popular tactical first-person shooter that emphasizes teamwork and strategy. Players can enhance their gaming experience by learning how to kick bots from matches, allowing for a more challenging environment. The game has evolved over the years, with different versions and modes catering to various types of players.

The Rise of Trading Bots in CS2: Benefits and Risks

The emergence of trading bots in CS2 has transformed the way players engage with in-game economies. These automated systems facilitate the buying, selling, and trading of items with minimal manual intervention, significantly enhancing efficiency. One of the primary benefits of using trading bots is their ability to operate 24/7, ensuring that users can take advantage of favorable market conditions at any time. Additionally, trading bots can analyze market trends more quickly than a human, enabling players to make informed decisions that can lead to greater profits.

However, the rise of trading bots also brings certain risks that players should be aware of. The use of bots can lead to market inflation, as automated trading may increase the volume of transactions without a corresponding demand for items. Furthermore, relying heavily on these systems can discourage players from developing their own trading skills. There are also concerns regarding the security of personal data, as some trading bots require access to sensitive information. Players must weigh the benefits against the risks to navigate the evolving landscape of trading in CS2.

How to Spot Scams in the CS2 Trade Jungle: Tips for Safe Trading

In the bustling world of CS2 trading, spotting scams can be challenging yet crucial for safeguarding your assets. One of the first tips is to always verify trader profiles. Look for trustworthy ratings and reviews from previous trades to gauge reliability. Additionally, be cautious of traders who display characters or accounts that are too perfect or offer deals that seem too good to be true. These are often red flags; genuine traders will provide competitive but realistic offers.

Another effective strategy is to employ secure trading platforms that offer built-in scam detection tools. Utilize platforms that allow you to trade with a middleman or an escrow service to ensure that your items are protected throughout the trade process. Always take the time to research the trading platform's policies and user experiences, as these insights can help you identify potential scams before they take place.